Overview: Responding to Tariffs

With Donald Trump’s recent announcements and un-announcement of tariffs, many firms are looking for strategic guidance on how to respond. The two most direct answers have been either to pass the tariff costs onto a firm’s customers or to shift supply to a different country. These answers bring more questions - how to model the correct passthrough and how to consider investments in an uncertain environment.

To help firms with these difficult questions, I built and solved three problems of increasing complexity to show how simple tools and careful numerical analysis can guide decision making. In order, we’ll model passthrough with elasticity of demand, production shifting with discounted cash flows, and uncertainty in tariff policy using real options.

Problem 1: Simple firm, simple tariff – what’s the right passthrough?

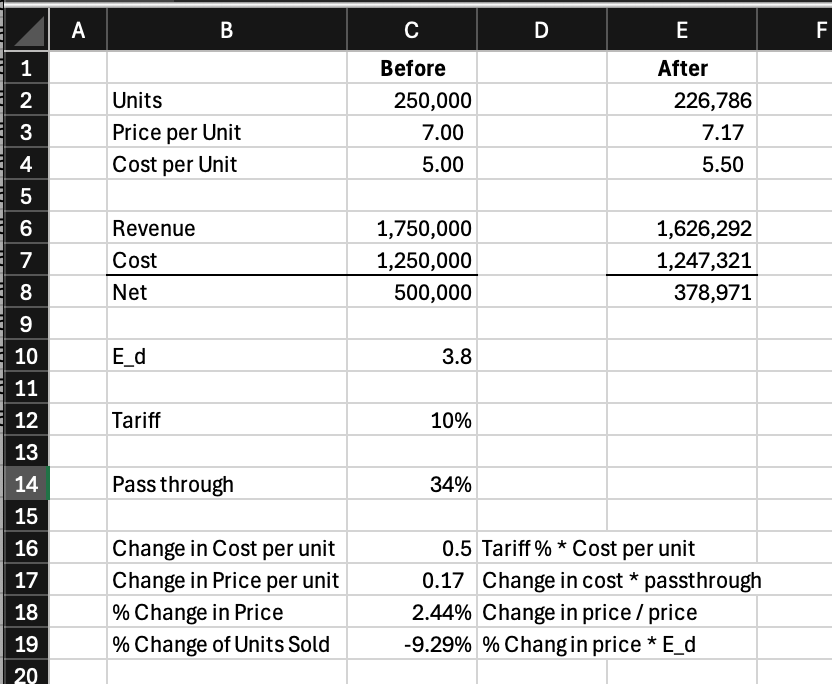

Suppose a hat maker in country X sells hats manufactured by its own factory abroad in country Y. Country X is set to impose an additional 10% import tariffs from country Y. The hat maker sells each hat for $7.00 with cost $5.00. The elasticity of demand for hats in country X is 3.8. How much of the tariff cost should the hat maker pass on to consumers?

The answer here depends on the elasticity of demand. The new cost per unit is going to be $5.50. The hat maker could choose to pass through the whole tariff and raise prices to $7.50, but that’s not the optimal solution since consumers are sensitive to changes in price. The elasticity of demand is defined as the % change in quantity purchased by the % change in price and tells us how consumers respond to changes in price. The percentage change in units sold will then be \( Units\ Sold \cdot \frac{ (1+Tariff\ \% \cdot Passthrough\ \%) \cdot Cost\ per\ Unit}{Price\ per\ Unit}\). With that, setting up a spreadsheet is simple. We can use the solver function in Excel to calculate the optimal passthrough rate by maximizing net income while varying the passthrough rate. That calculation yields the optimal passthrough rate of 34%

Problem 2: Certain Tariff and Production Shifting

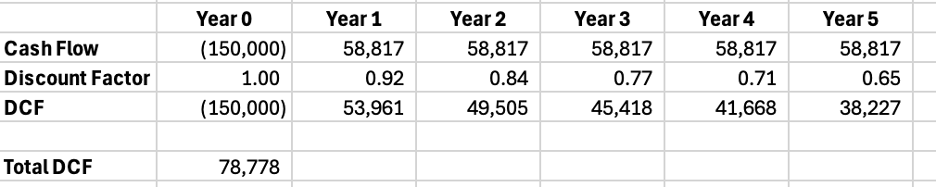

Now take the scenario in Problem 1 and add another decision. Suppose the hat maker can shift production from Country Y to Country Z to avoid the tariff. The firm will face an investment of 150,000 to shift the production and will face 5% higher pre unit costs over the present day, non-tariff base case. The product’s market lifespan is estimated to be 5 years and cost of capital is 10%. Should the firm shift production or not?

In this case, we need to first establish how much of the 5% cost increase the firm will pass on to consumers like problem 1. We setup much of the same calculation and plug it into solver. The maximum net income is achieved at 18% passthrough of the 5% cost increase.

Shifting production yields a net of 437,788 versus facing the tariff which has a net of 378,971. The net difference is 58,817 in favor of shifting production to country Z. There is a catch though – we face an investment of 150,000. So now we need a discount cash flow analysis to determine if the investment is viable. A simple DCF gives us:

Since the discounted cash flows are positive, the hatter should shift production to country Z.

Aside: Closed form for the passthrough % for a tariff

For the next step, we’re going to need a closed form equation with the optimal value for the passthrough % as Excel will have too many things to parametrically solve. The optimal value of the passthrough % will maximize the profit function after the cost tariff or cost increase has been applied. If we have profit function after tariffs: \( profit_t = (price_t - cost_t) \cdot units\ sold_t \), then setting the first derivative with respect to the passthrough % to 0 will give us the optimal value.

I’m lazy, so I used Mathematica to do the maths. If q is the passthrough %, c, p, are the cost and price before tariffs, e is the elasticity of demand, t is the tariff percentage, then profit is maximized at:

\[ q=\frac{ce-p-ep+cet}{2cet} \]

Problem 3: Production shifting under tariff uncertainty

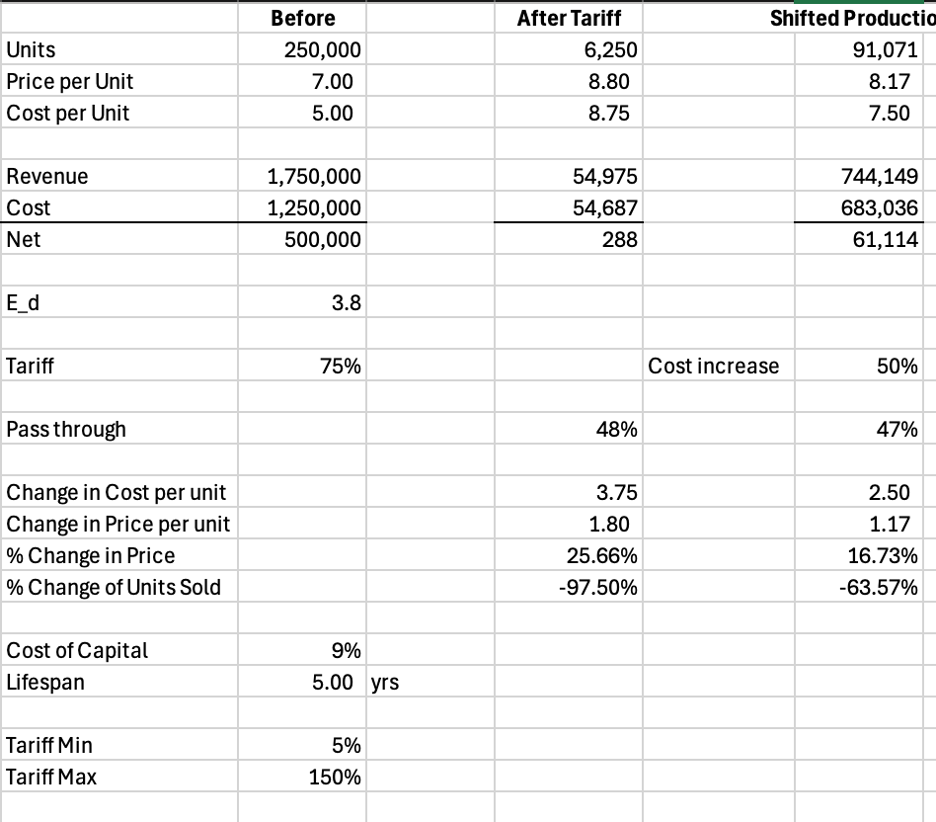

Let’s turn it up another notch. Suppose that our milliner faces the same investment decision as in Problem 2. Consider though that the political regime of country X is capricious. Suppose that expert opinion suggests a tariff of anywhere between 5% and 150% with uniform distribution will be instituted starting the following year.

Furthermore, consider that costs will increase by 50% if the firm shifts production to country Z since labor is more expensive and has fewer hat makers. The firm must decide in the current year whether to make investments to shift production or not. The firm can choose to build the capacity in country Z but retain the production in country Y and expire the investment

The mad hatter’s margin is currently 28.5%. If the tariffs are implemented at 5%, then the firm prefers to keep production in country Y, but if the tariffs are implemented at 150%, and the firm does not build capacity in country Y then the firm will certainly be wrecked.

We can think of the mad hatter’s decision as a real option. We’re going to model the DCF of the investment decision at each value of the tariff. Our setup looks like this now:

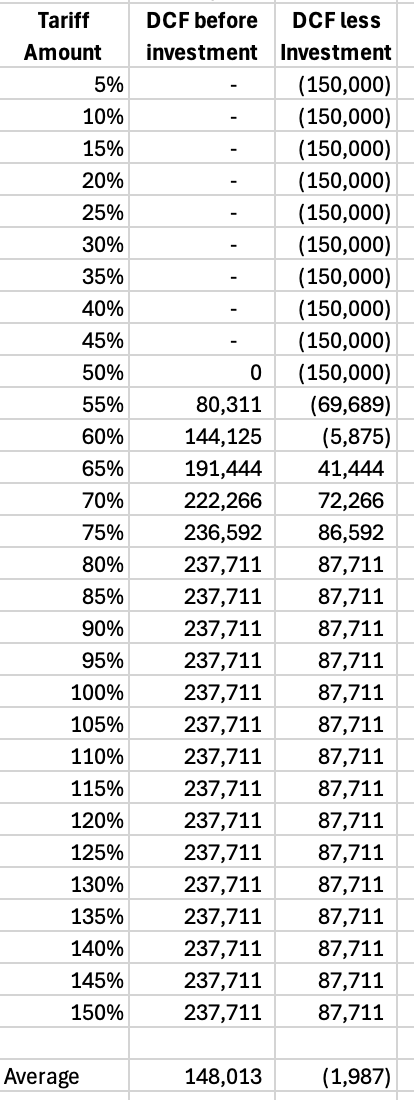

We need the closed form for the ideal passthrough from our aside since we’ll use Excel’s Data Table to punch out the values of the real option for every tariff %. For tariff % of 5% to 50%, we get that the hatmaker would retain production in country Y and the investment would be for nought. For tariff % of 55% to 150%, the hatmaker would shift production to country Z and for tariff values above 80%, if the hatmaker kept production in country Y, they would go bust.

The return of the option is 148,013, but the investment is 150,000. So, if the hatmaker is risk neutral, then they would choose to retain production in country Y. We should be careful though – if our hatmaker invests in Country Z, they face 33% odds of the investment expiring unneeded. If they don’t, they face 50% odds of failure. This decision is fraught and would depend on the risk aversion of the firms’ managers and investors.

Further Expansions of our Tariff problems

Our three example problems show how responding to tariffs requires consideration of elasticities of demand in being able to pass tariff prices through to consumers, how to evaluate an investment decision to shift production to a different country, and finally how to evaluate the investment to shift production when the tariff is uncertain.

This analysis can be pushed further. First, we held our supply function relatively constant. We could consider a situation where our hatmaker is buying hats from independent manufacturers in country Y. We can then consider the elasticities of supply and how they impact our hat maker’s decisions.

Second, we used very fixed values for our elasticities and costs. Most companies do not face a particular constant elasticity of demand, and so instead we could consider a more robust curve for the elasticity of demand. We also assumed that the costs were purely variable and fixed per unit. That of course is not borne in practice. We could model a cost function with mixed variable, fixed, and stair step components. Our investment for setting up in Country Z is also very simple – one could imagine a pilot light being setup that

Third, our model for tariff uncertainty only used a uniform distribution with a single decision point. Our model could be pushed further with a more complex probability distribution – say normal or binomial distribution. We could also consider that Country X’s tariff could be implemented in any particular year or could be modified over time.

Finally, we could also consider what other competitors in a market will do. If the hat maker is oligopoly and has a better tariff position than its competitors, then it may try to reduce the passthrough of the tariff to squeeze its competitors who face larger cost increases.

The Excel file with the calculations is available here: